TRANSCRIPT

Copyright 2009 by National Stock Exchange of India Ltd. (NSE) Exchange Plaza, Bandra Kurla Complex, Bandra (East), Mumbai 400 051 INDIA All content included in this book, such as text, graphics, logos, images, data compilation etc. are the property of NSE. This book or any part thereof should not be copied, reproduced, duplicated, sold, resold or exploited for any commercial purposes. Furthermore, the book in its entirety or any part cannot be stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise.

1

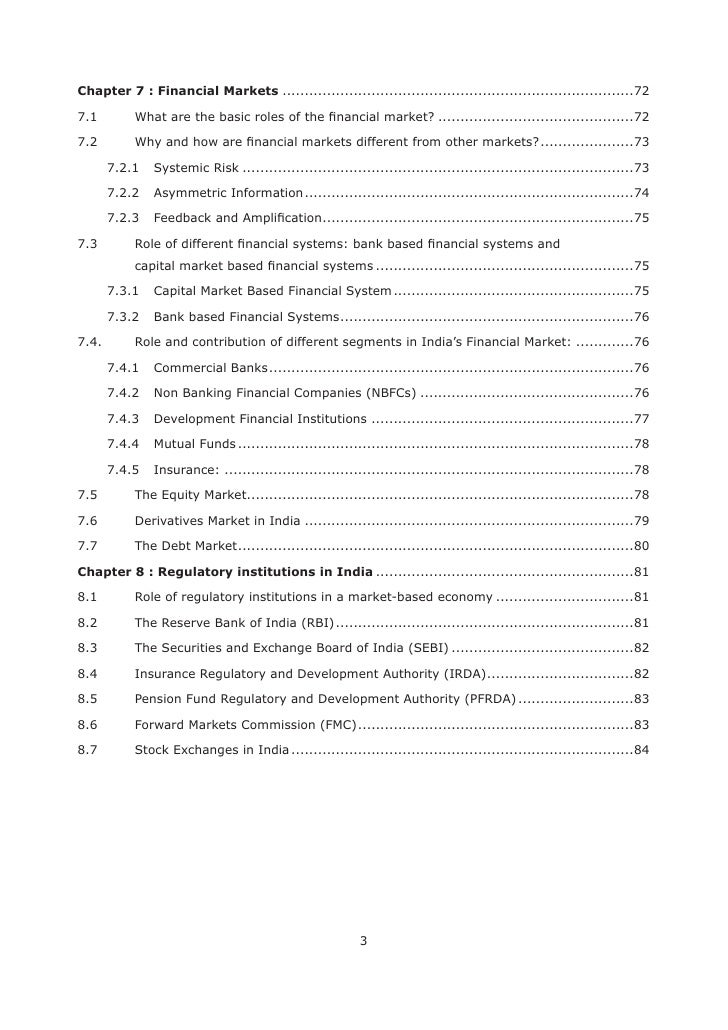

CONTENT ................................................................................................................................PAGE NO.S

LIST OF ABBREVIATIONS .....................................................................................................................5 CHAPTER 1....................................................................................................................................................7 TRADING........................................................................................................................................................7

1.1 INTRODUCTION.................................................................................................................... 7 1.2 NEAT SYSTEM ........................................................................................................................ 9 1.3 MARKET TYPES...................................................................................................................... 9

1.3.1 Normal Market .....................................................................................................................9 1.3.2 Odd Lot Market ....................................................................................................................9 1.3.3 Retdebt Market ...................................................................................................................10 1.3.4 Auction Market...................................................................................................................10

1.4 CORPORATE HIERARCHY .............................................................................................. 10 1.5 LOCAL DATABASE ............................................................................................................. 11 1.6 MARKET PHASES ................................................................................................................ 11

1.6.1 Opening................................................................................................................................11 1.6.2 Open Phase .........................................................................................................................11 1.6.3 Market Close.......................................................................................................................12 1.6.4 Surcon..................................................................................................................................12

1.7 LOGGING ON........................................................................................................................ 12 1.8 LOG OFF/EXIT FROM THE APPLICATION.............................................................. 14 1.9 NEAT SCREEN...................................................................................................................... 15 1.10 INVOKING AN INQUIRY SCREEN.............................................................................. 16

1.10.1 Market Watch.................................................................................................................16 1.10.2 Security Descriptor........................................................................................................18 1.10.3 Market by Price..............................................................................................................19 1.10.4 Previous Trades .............................................................................................................20 1.10.5 Outstanding Orders.......................................................................................................21 1.10.6 Activity Log.....................................................................................................................21 1.10.7 Order Status....................................................................................................................22 1.10.8 Snap Quote......................................................................................................................23 1.10.9 Market Movement..........................................................................................................24 1.10.10 Market Inquiry................................................................................................................24 1.10.11 Auction Inquiry...............................................................................................................25 1.10.12 Security/Portfolio List...................................................................................................26 1.10.13 Multiple Index Broadcast and Graph.........................................................................26 1.10.14 Online Backup................................................................................................................27 1.10.15 Basket Trading...............................................................................................................27 1.10.16 Buy Back Trades............................................................................................................28 1.10.17 Supplementary Functions.............................................................................................29

1.11 ORDER MANAGEMENT ................................................................................................... 42 1.11.1 Entering Orders .............................................................................................................42 1.11.2 Order Modification........................................................................................................49 1.11.3 Order Cancellation.......................................................................................................49 1.11.4 Order Matching..............................................................................................................50

1.12 TRADE MANAGEMENT .................................................................................................... 53 1.12.1 Trade Cancellation........................................................................................................54

2

1.13 AUCTION ............................................................................................................................... 54 1.13.1 Entering Auction Orders ..............................................................................................55 1.13.2 Auction Order Modification.........................................................................................56 1.13.3 Auction Order Cancellation.........................................................................................56 1.13.4 Auction Order Matching...............................................................................................57

1.14 LIMITED PHYSICAL MARKET ..................................................................................... 57 1.15 RETDEBT MARKET (RDM) ........................................................................................... 57 1.16 TRADING INFORMATION DOWNLOADED TO TRADING MEMBERS .... 60 1.17 INTERNET BROKING ..................................................................................................... 63

Model Questions..................................................................................................................................63 CHAPTER 2..................................................................................................................................................66 CLEARING AND SETTLEMENT ........................................................................................................66

2.1 INTRODUCTION ................................................................................................................ 66 2.1.1 Transaction Cycle..............................................................................................................67 2.1.2 Settlement Process.............................................................................................................68 2.1.3 Settlement Agencies...........................................................................................................69 2.1.4 Risks in Settlement .............................................................................................................72

2.2 SETTLEMENT CYCLE......................................................................................................... 73 2.3 SECURITIES SETTLEMENT ........................................................................................... 77 2.4 FUNDS SETTLEMENT ....................................................................................................... 79 2.5 SHORTAGES HANDLING ................................................................................................ 81

2.5.1 Valuation Prices.................................................................................................................82 2.5.2 Close-out Procedures........................................................................................................82

2

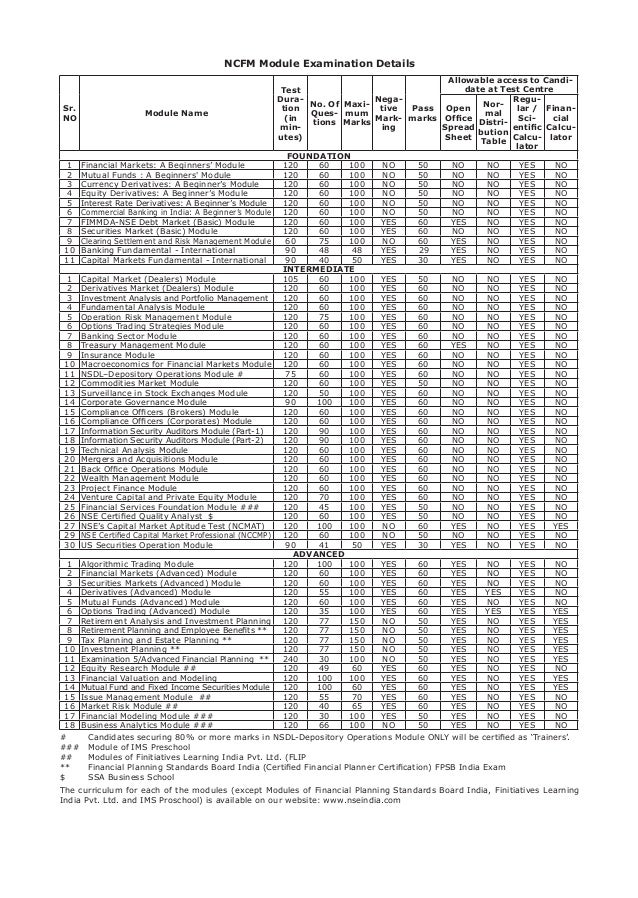

To rezearch the NSDL application software. A Beginner's Module This is a basic level programme for those who wish to either begin a career in the financial markets in India or simply learn the fundamentals of capital markets. NCFM modules are divided into three broad categories including Beginner, Intermediate and Advanced. Issue Management Module. Market Risk Module. Financial Modeling Course. Financial Services Foundation. NCFM currently tests expertise in the above mentioned modules. Details of all the modules can be found at NSE's web site i.e.

Ncfm Insurance Module – Download as PDF File .pdf), Text File .txt) or read online. Insurance Module NCFM Certification question bank available for preparation of NSE certified exams mock model test paper, more than question answers. NSE has taken a step further and introduced a module on insurance. Normally the modules which NSE has are for securities market.

| Author: | Kigrel Goltizshura |

| Country: | Lebanon |

| Language: | English (Spanish) |

| Genre: | Career |

| Published (Last): | 9 August 2014 |

| Pages: | 23 |

| PDF File Size: | 1.42 Mb |

| ePub File Size: | 5.39 Mb |

| ISBN: | 346-7-20157-894-5 |

| Downloads: | 92986 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Zologul |

You are commenting using your WordPress. I have exam on 14th feb, of insurance module i want to know that is there any questions which are repeating in insurance module like cfp all module.

Training Profile of AKSHAYA INVESTMENTS We have been training individuals in NCFM, BCFM and NISM modules for the past 7 years. Over the last 7 years, we have delivered over 10,000 Hours of mass outreach education to financial intermediaries, Bankers, Individual agents, Students etc in over 20 Cities. NCFM Modules Study Material PDF. Learn Money making Strategies used by Professionals. NCFM certifications are industry standard, recognized by Securities & Exchange Board of India (SEBI) and are compulsory for persons working in Financial Markets. Thousands of employers nationwide recognize the value of NCFM Certifications.

Thank You for submitting your response. Your item has nctm added to Shortlist. Was this information helpful to you? Thank you for your interest You will be notified when this product will be in stock. How can we help you? You can leave a responseor trackback from your own site. We will let you know when in stock.

You are commenting using your Facebook account.

Issue Management Module. Market Risk Module. Financial Modeling Course. Financial Services Foundation. NCFM currently tests expertise in the above mentioned modules. Details of all the modules can be found at NSE's web site i.e.

NCFM: Insurance Module « Prashant V Shah

Email required Address never made public. You have reached the maximum number of selection.

Please press enter for search. Online Study Material Disclaimer: Normally the modules which NSE has are for securities market.

Online Mock Test for Insurance Module NCFM Certification Course Online Study Material

Ncfm Modules Book Pdf

Item s Added To cart Qty. India’s fastest online shopping destination. Exchange Discount Summary Return form will be sent to your email Id: Help Center Got a question?

Exchange offer is not applicable with this product. Financial Planning at Income Tax Department.

Prashant- Could you please provide the link to download the study material of insurance module of NCFM? Online Delivery via E-mail. I agree to the. Exchange offer not applicable. Notify me of new comments via email. Quick links Product Type: Online Study Material Language: There is an increased need for qualified individuals who possess requisite skills and significant knowledge in insurance in these fast moving and globalised financial markets.

Lets have a look at the module: You are commenting using your Twitter account. Exchange Offer cannot be clubbed with Bajaj Finserv for this product.

Fill in your details below or click an icon to modhle in: Financial Planning at Nirma Institute of Management. You can select only upto 4 items to compare.

This entry was posted on November 24, at 2: Prashant Shah on CFP. By continuing to use this website, you agree to their use.

New product price is lower than nncfm product price. For successful candidates, certificates are valid for 5 years from the test date. If it is please provide me questions. Posted by Prashant Shah on November 24, Nse offers insurance module ncfm certification for those want to make career in financial and insurance sector. Please apply exchange offer again.

Ncfm Study Material

(NCFM) Insurance Module Online Examination

Who will benefit from this course? NSE has taken a step further and introduced a module on insurance. Seller Details View Store.