Spend Fake pay stub maker free is An immediate document that has certain layouts of pay stubs where by the consumer can edit in order to utilize it by will need. A pay out stub is often a type of evidence of wage or payment for the employee. Domestic worker payslip template downloadclick here to downloadEmployers must give this pay slip to workers Download Sectoral Determination 7 allows for deductions from a domestic worker 's pay only. Open form follow the instructions. Easily sign the form with your finger. A payslip template is formal document which is given to employee along with his salary. It is very beneficial for employee as it helps him to make sure that he is on the right tax code, right amount has been deducted as tax, what amount has been earned by him.

Working in an organization, you may have often come across a slip addressed directly to an employee indicating their salary and allowances for a particular month. This slip is known as a payslip. Payslips are issued every month and to every employee. A pay slip is a statement showing how much an employee earned in a gross amount less the deductions for Special funds such as Providence and pension funds. Payslips are commonly used in organizations big or small.

In older days, pay slips were printed and given to employees as hardcopy. This practice is still common in some organizations. Many organizations also choose to email the payslips to employees.

Large organizations usually have online portals for their employees to manage their profiles, file online applications, and manage other administrative duties. These organizations also use the employees’ portal to upload payslips. So, each employee can log in into the portal and access their payslip online. Uploading on the online portal saves considerable paper and expense.

There are several benefits of payslips. Payslips are a way of communication about the salary between the organization and its employees and it works to effectively minimize any misunderstandings. Payslips can also prove helpful during external and internal account audits. Payslips are useful in comparing discrepancies that may arise when calculating provident or pension funds.

Every organization, big or small, issues payslips to its’ employees. A payslip is a statement of income and deductions for a particular employee. Each payslip is unique to a particular employee with their name on it. The payslip for one employee cannot be given to another since it is addressed to the employee with his/her name and employee ID.

Payslip and payroll both refer to two separate concepts. A payslip shows the salary and deductions for a particular employee only. On the other hand, a payroll is the list of all the employees working in an organization. The payroll not only lists the employees but also their salaries, bonuses, and any taxes withheld. Thus, the payroll is the total amount of salaries paid by an organization, and a payslip is for an individual employee.

In terms of importance, a payslip is important for the employee, so they are aware of the breakdown of their salary. Similarly, the payroll is critical for the HR department in the organization since any discrepancy in the payroll may cost the organization a huge loss. It is the responsibility of the HR department to ensure that the payroll is accurate and timely.

Both payroll and pay slips are generated at regular intervals. These intervals can be weekly, bi-monthly, or monthly. The most common duration is monthly.

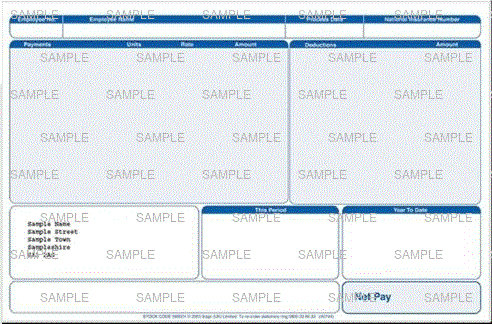

A payslip generally includes:

- name of the organization

- name of the employee

- employee ID

- gross salary for the month

- any allowances such as housing, travel or communication allowance

- bonuses if applicable

- deductions for providence fund, pension funds

- taxes withheld

- net salary

A payslip may also include the past few months’ histories of gross and net income. The net salary is the take-home salary that the employee can spend.

A payslip is an internal, yet binding document issued by an organization. If someone wants to apply for a loan or credit card, they can use previous payslips as proof of salary. Moreover, by law, every organization must provide payslips to all its employees every time a payment is made to the employees. Thus, an organization that pays bi-monthly, must provide bi-monthly payslips. Thus, payslip is a legal document.

See the templates below.

Preview

MS Excel [.xls] | Download

Weekly Payslip template

MS Excel [.xls] | Download

Biweekly Payslip Template

MS Excel [.xls] | Download

Monthly Pay Slip Template

MS Word [.docx] | Download

The pay stub lists the details salary information of the employee, it is part of the payroll. The required information on the pay stubs varies from state to state. You can get a corresponding free pay stub template based on the specific requirements on pay stub of your state. The following is the common information to be included in most pay stub templates:

The name and address of your company.

The name and employee ID of the employee.

Employee Payslip

The pay period represented.

Fake Payslips Download Online

The date that to pay to the employee.

The total wages, regular and overtime pay is included.

Commissions, tips or other earnings.

The pre- and post-tax withheld from the employee’s wages.

The employee’s net earnings.

To ensure your pay stubs contain the required information of your state and are correctly calculated, strongly suggest you to use a payroll provider like Gusto.